InsMark Symposium

Symposium

Money Talks . . . Let InsMark Do the Translation®

InsMark’s Virtual Symposium is the insurance industry's #1 marketing conference where the industry's sharpest minds and most creative leaders come together to teach and share new and exciting sales ideas. Missed the event? Register online to access our On Demand sessions within the Attendee Hub.

Agenda

View the detailed Symposium Agenda

The agenda is available on Cvent’s website. Clicking this link will redirect you to our agenda page on their site.

Who should Attend?

Everyone is welcome to attend the Symposium: financial planners, estate planners, life insurance agents, CPAs, Home Office personnel, support staff, and anyone who wants to expand their knowledge and grow to new levels. Attend once, and you will learn why the majority of our attendees return year after year and how they earn in excess of $400,000 in commissions annually. Great for the industry's new and advanced alike, the Symposium is also an excellent networking experience.

See what fellow producers have to say about InsMark Symposiums . . .

More Benefits!

Value-added benefits from Symposium attendance are below:

- Learn how to capitalize on opportunities arising from the changing tax environment

- Learn what it takes to capture the most coveted markets with InsMark's software platform

- Connect with speakers and industry experts for more in-depth exchanges

- Gain real case tips from the trenches - shared by the most proficient InsMark licensees

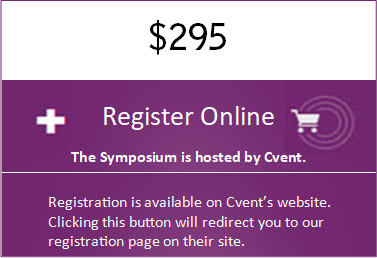

Registration Fee

The Symposium registration fee is $295.

Who are the Symposium Speakers?

This year's InsMark Symposium speakers consist primarily of highly-skilled financial advisors who bring well-rounded points of view to current trends using InsMark Systems. Each presentation will present eye-opening case studies, providing critical takeaways for creative solutions for your current and upcoming client cases.

Meet the Platinum sponsors of the InsMark Symposium 2023

(Click on the logos below to find out more about each sponsor.)

How to Attend our Virtual Symposium

1. Which browser should I use?

For the best viewing experience, we recommend the following browsers: Chrome and Firefox. If viewing in other browsers, you may experience lags in streaming.

2. Log in to the Symposium

Click Here to access the On Demand Catalog

Enter your info: You’ll be prompted to enter your first name, last name, and email address. Then click Next.

Verify your account: You’ll receive an email or text message to your mobile phone containing a verification code. Copy this code, return to your browser, enter the code, and click Log in. You’ll then be taken to your homepage of the Hub.

Please note: Verification codes can only be used once and expire after 24 hours. If you are logging in on multiple devices, you’ll receive a new verification code for each.

3. Didn’t get the verification code?

- Check your spam or junk folder for the code.

- If you provided your mobile number during registration, check your text messages for the code.

- If the above does not work, call InsMark Support at 925-543-0507.

4. How do I join the live sessions?

Make sure you are logged into the Hub, go to the Schedule tab, click on All Sessions, and click on whichever session you would like to attend. Five (5) minutes before the scheduled start time, you will see ‘Join session’. Select ‘Join Session’ to launch the video player where you can view the session and ask questions.

If you miss any sessions, you can watch them on playback within the Hub from November 13, 2023, through February 7, 2024.

5. Where do I input my questions for the Q&A sessions?

Use the Q&A icon located on the right-side panel of the Hub. You can ask questions anonymously or with your registered name. The presenters will answer questions during the Q&A Sessions.

6. What are virtual booths?

A virtual booth carries the same idea as a physical booth. As an attendee you can meet and greet Exhibitors, discuss their products or download product flyers. To find a virtual booth, click the ‘Exhibitors’ tab in the Hub. Click on the relevant exhibitor to reveal a description about their organization & services, and the onsite staff available.

7. How can I contact the exhibitors?

You have three options. Each exhibitor profile has the following:

- Meet Now button, which allows you to visit virtually with them, using Zoom.

- Chat button, which allows you to engage in 1:1 private chat.

- Contact Us button, which allows you to send a message sharing what you’d like to talk about.

8. How can I contact another attendee?

Under the Community tab, you can see who is in attendance, and search for attendees by specialty areas. During pre-designated networking timeslots, you can engage in 1:1 messaging with other attendees by selecting the Message button.

9. What if the sound quality is poor?

If you are experiencing poor sound quality with your laptop speakers, we strongly recommend using earbuds to enhance the sound quality.

10. What is the Virtual Attendee Hub?

This platform is used to run the InsMark Symposium | Virtual event, giving you an all-in-one virtual experience.

11. Can I change the Agenda to display my time zone?

Yes, to adjust the time zone, select the View Profile Icon then Settings. Select Language and Time then My device’s time zone.

12. My profile is showing in the Attendees list. How do I become hidden?

Select the View Profile Icon then View profile, and then change the Visibility Settings to Hidden.